>>https://drive.google.com/file/d/0B1LLz-ESkJjDSGQ1UTVPOU9adjRDaVZRYW5mVWFaYV9KWTFR/view?usp=sharing<<

Saturday, April 30, 2016

JAMES KIDNEY FORMER SEC ATTORNEY CAN BE THE HUCKLEBERRY FOR AMERICA OH HOW PROMISING

By Pam Martens: December 15, 2014

Today we welcome former SEC attorney, James A.

Kidney, as a guest columnist to our front page. Mr. Kidney brings 25 years of

SEC experience and wisdom to the conversation. Here’s the backdrop:

The U.S. Department of Justice has been

burning through millions of dollars of taxpayer money chasing down suspected

insider traders who are four and five times removed from the person leaking

inside information; convening grand juries to indict the traders; convincing

trial courts to send them off to prison. The Securities and Exchange Commission

has gone after the same individuals, banning them for life from the industry.

That’s the same DOJ and SEC that have failed to bring charges against one CEO

of a major Wall Street firm for the crash of 2008 — the greatest and most

corrupt financial collapse since the Great Depression.

Last week, in a wide-reaching decision, the

U.S. Court of Appeals for the Second Circuit, in United States of America v Todd

Newman, Anthony Chiasson effectively advised Americans

that the Department of Justice has grossly misapplied insider trading laws. And

since the SEC has targeted the same individuals using the same legal principle,

the decision means the SEC also doesn’t understand the laws it is supposed to

be carrying out.

In a nutshell, the Court found that to be

guilty of a crime the person trading on inside information has to have

knowledge that the inside tipster breached a duty of trust to the corporation

in exchange for a personal benefit. That knowledge was missing in many of these

traders who were four and five times removed from the tipster. In fact, the

court found that there may not have even been a tangible personal benefit to

the tipster.

In simple terms, if a corporate insider gives

material non-public information to a trader in exchange for cash or something

of value, and the same trader then trades on that information, that’s a classic

case of insider trading. But when the traders have no knowledge of any personal

benefit given to the tipster, there is no insider trading crime.

Whether this is good law or bad can be

debated. For example, corporate insiders might leak information for no current

personal benefit on the hope or expectation that in the future they’ll be

rewarded with a plum job and fat compensation at the trader’s firm. (That form

of quid pro quo is a staple on Wall Street.)

The message the Appeals Court might have been

subtly sending to the DOJ and SEC is to stop casting their wide net at people

four times removed from a crime scene and go after the real criminals on Wall

Street whose past and current actions pose a real and pressing danger to the

entire financial system.

We turn the discussion over to James A.

Kidney, who caused quite a stir earlier this year in a speech at his retirement

party criticizing SEC management for policing “the broken windows on the street

level” while ignoring the “penthouse floors”.

Finding the Courage to Go After the Big Fish

By James A. Kidney: December 15, 2014

James A. Kidney, Former SEC Trial Attorney

Most of the highlights of my 25-year career as

a trial attorney at the Securities and Exchange Commission involve the half

dozen or more insider trading cases I tried before juries. I was lead

counsel in the very first jury trial the SEC ever brought – an insider trading

case in Seattle in 1989. I prevailed on behalf of the SEC in every one of

my insider trading trials.

I wish I could say these victories achieved

something important for securities enforcement. I doubt that they did.

Those cases tried against other than true corporate insiders were largely a

waste of government (and my) time. As were the far more numerous such

cases which settled without trial, sometimes for substantial sums by any

standard, and sometimes by such small sums they were substantial only to the

middle class sap who acted on a stock tip and had the misfortune to be

persecuted by the SEC.

Investigating and litigating insider trading

cases are probably the most fun the SEC Enforcement staff has as it muddles

around the oft-amended, often confusing statutes and rules embedded in 70 year

old basic securities laws that are long past their sell-by date. Of all

the common securities law claims brought by the SEC as civil cases (and,

sometimes, by the Department of Justice as civil or criminal matters), insider

trading requires investigations that are the most like Sam Spade detective work

as seen on film and television. Insider trading is often like finding out

who killed Colonel Mustard in the library with a candlestick. I know I enjoyed

them, even as I doubted their utility.

The investigation team at the SEC (and the

U.S. attorneys’ offices) first have to figure out if information was leaked

from a corporate source. Maybe the trading on good or bad news was a corporate

source using a beard, such as a friend or neighbor. Maybe the corporate

source was getting paid, in cash, favors, future employment, or some other

benefit, for passing on material nonpublic information to a stock trader.

It is fun trying to track down the inside source, usually working backwards

from someone who made a timely purchase or sale in advance of good or bad

corporate news. Finding the key telephone call or other communication and

then springing the evidence on the defendant in a deposition or courtroom is a

thrill rare in the annals of securities litigation. A little like Perry

Mason, if I may date myself.

In addition to working backwards to the

source, the staff usually will also work forward, finding persons who traded at

several levels removed from the insider. I have tried cases, and

prevailed in front of juries, in which the defendant was several levels removed

from the insider. In my most extreme case, the defendant was five

levels removed from the original source of the information. The source

was supposedly the brother of a guy who worked for the company and received

information from his brother. The brother called his broker – but didn’t

trade himself when the broker told him doing so would be illegal. But the

broker couldn’t keep his mouth shut and told some of his customers, who told

their friends, who told their friends. The SEC sued about a dozen people in

this chain (but not the original insider). All but the fifth level guy

settled. We tried the case against him, a high school dropout who operated a

scaffolding company and who was his own lawyer. After a four-day trial in

front of a senior federal judge, the SEC prevailed with the jury. Whooo

Hoo! Markets saved.

In my view, as a recently retired SEC trial

lawyer, the Commission spends far too many resources on pursuing low level

“insider traders” who are far removed from the corporate suite. Most of

these cases have zero impact on market prices or practices. So-called

“remote tippee” cases employ legal fictions that are fuzzy at best and often

outright unfair and unrealistic. Insider trading cases rely on “legal

fictions” of transferred duties from the insider to one tippee, to another

tippee, to a third tippee, who might have been tipped on the golf course by a

friend who vaguely says he got it from a guy who knew a guy at the subject

public company. These actions put the emphasis on “fiction” in legal

fiction.

Such cases are not by any means the only waste

of enforcement resources. The Commission staff typically spends much time

near the end of the fiscal year (September 30) boosting its enforcement numbers

with window dressing cases, such as administrative follow-ons to criminal

convictions, some years old, filing actions to deregister defunct corporations

and bringing minor administrative actions against corporate officers who fail

to report stock transactions as required by law. The press and Congress,

as well as the Commissioners themselves, want the enforcement numbers pumped

up. And the press uncritically considers the raw enforcement numbers a

measure of the success or failure of the Division of Enforcement. No matter

if large numbers of cases are the equivalent of jaywalking tickets while banks

are being robbed (or, rather, doing the robbing). The numbers are

up! Again, Whooo Hoo!

This practice is defended by the current SEC

chair and the current director of the Division of Enforcement as the “broken

windows” theory of “law enforcement,” as if big Wall Street firms gave a dam

whether a smalltime Joe got nailed by the Big Bad SEC. As is well-known,

much of the SEC docket is devoted to enforcement against such small timers.

“Broken windows” might be tolerable, if the

SEC staff did not also shy away from the big picture windows on the upper

floors of Wall Street. I know from personal experience at the SEC that

the Division of Enforcement has been loath to bring perfectly colorable fraud

actions against more senior insiders at the big banks that brought us the 2008

financial crisis and their large customers. Division of Enforcement

senior management, presumably at the behest of the chairman at the time,

actually had a virtual template for the SEC staying its hand in other cases

involving other large Wall Street institutions – grab a big fine from the

institution and sue a very small fry. After all, a firm like Goldman

Sachs will let a junior vice president peddle a billion dollar product with no

supervision, right?

I often pictured some banking fat cat reading

a headline about the SEC or DOJ nailing some “broken windows” defendant and

thinking, “Keep it up. Leave me alone.”

All of which brings us to the good news about

last week’s decision by a panel of the U.S. Court of Appeals for the Second

Circuit in U.S. v. Newman. In that criminal case brought by

the Office of the U.S. Attorney for the Southern District of New York, the

court unanimously held that the prosecutor must prove that remote tippees knew

that the original insider who provided material nonpublic information did so in

return for a personal benefit. This was a straightforward reading of a

30-year-old Supreme Court decision which the SEC and the Justice Department over

the years had turned into a practical nullity in remote tippee cases such as Newman.

The press reaction has been all about how

damaging this decision will be to insider trading enforcement. Yes, it will

serve as a major deterrent to bringing enforcement actions, civil or criminal,

against remote tippees who had no personal contact with the corporate insider

and often do not even know his or her name or corporate position. Until now, as

a practical matter, the prosecution had only to persuade a jury that a remote

tippee defendant had sufficient facts to know, or, in an SEC civil case, was

reckless in not knowing, that the information on which the defendant traded

likely came from an insider corporate source, that it was material and that at

the time the defendant made the trade it was still nonpublic. In other words,

that the defendant knew he was acting on what he thought was a “hot stock tip.”

Of course, the defendants in U.S. v. Newman

were not small fry. They were traders employed by crème de la crème hedge

funds, which is why the reversal and dismissal of their criminal convictions

and long white collar prison sentences causes such consternation. But

acting on a hot tip, even knowing that it probably came from a corporate

insider (and thus was more reliable than mere gossip) stretches notions of

securities fraud far beyond safe boundaries for society. The rules of proper

behavior are too ill-defined when information is received far from its source,

even if the defendants or their employers are among the One Percent, as in Newman.

Most important, remote tippee insider trading does little economic damage to

the markets — certainly far less damage than the billion dollar deals put

together by Wall Street and sold as relatively safe when they are in fact built

on soft mud – but it’s an easy win and fun to work on, at least at the SEC.

I don’t go along with those who say insider

trading should be legal because it adds information to the market through

trading. I am very skeptical of the whole efficient markets theory, and there

are concrete reasons to bar insiders from benefitting from corporate

information. Insiders are paid a salary and often bonuses – sometimes

quite large – and should not be taking advantage of their position for

additional personal gain, especially at the expense of shareholders lacking the

inside information and, therefore, willing to trade their shares. Nor

should they be permitted to advantage their friends and relations by tipping

them to inside information as a gift. The court’s decision in U.S. v.

Newman does not change the existing law in this regard.

The

really good news about U.S. v. Newman, should it not be reversed on

appeal or circumvented by clever SEC and DOJ lawyers, is that all those

resources spent in going after remote tippee defendants such as those I made a

career of prosecuting (at the direction of my bosses) can now be used to ferret

out conduct far more damaging to the markets and, sometimes, the economy. That

is, if the aforementioned SEC and DOJ ever find the courage to do so.

WALL STREET AND ARCHANGEL MICHAEL DOING BATTLE? OFFICE OF THE COMPTROLLER OF THE CURRENCY NEEDS THE ANGELS AND ARCHANGELS ALL IN THE TIME THAT IS

>>Is the Wall Street Cartel Regrouping? Regulator Fires Warning Shot<< By Pam Martens and Russ Martens:

| |

| April 28, 2016 |

Bethany Dugan, Deputy Comptroller for Operational Risk at the OCC

Well, apparently, one or more banks are causing concerns in this area again.

Yesterday, the regulator of national banks, the Office of the Comptroller of the Currency, sent out a severe warning to its flock that there could be a five year jail sentence waiting in the wings for anyone attempting to use technology to block its mandated access to bank records. The letter was authored by Bethany Dugan, Deputy Comptroller for Operational Risk. The statement read in part:

“The OCC has become aware of communications technology recently made available to banks that could prevent or impede OCC access to bank records through certain data deletion or encryption features.” Another part of the memo honed in on the chat room issue, noting that “…OCC is aware that some chat and messaging platforms have touted an ability to ‘guarantee’ the deletion of transmitted messages. The permanent deletion of internal communications, especially if occurring within a relatively short time frame, conflicts with OCC expectations of sound governance, compliance, and risk management practices as well as safety and soundness principles.”

Curiously, a footnote called out the Board and bank management of unnamed banks, suggesting that there has been a concerted effort to block the OCC examiners from access to chat rooms and/or to speak directly to bank staff:

“Failure to provide timely access, or

efforts by the board of directors or bank management to impede the bank

staff’s ability to provide such access, may result in enforcement

action. Furthermore, examination obstruction may subject individuals to

criminal prosecution. Refer to 18 USC 1517, ‘Obstructing Examination of

Financial Institution.’ ”

The statute referenced by the OCC, 18 USC 1517, is succinct and

harsh: “Whoever corruptly obstructs or attempts to obstruct any

examination of a financial institution by an agency of the United States

with jurisdiction to conduct an examination of such financial

institution shall be fined under this title, imprisoned not more than 5

years, or both.”Wall Street watchers are speculating that this may be another dustup over the communications system called Symphony that was initiated by Goldman Sachs. Goldman provides a detailed explanation on its web site about how it built out this system and admits that it got a “consortium” of other mega banks and hedge funds to join its plan. It also explains how it hired an expert in “encryption” to head it up, writing:

“In an effort to further develop and

evolve the platform, Goldman Sachs built a consortium of the world’s

leading financial services firms and acquired Perzo, a Palo Alto startup

led by David Gurle, an expert in encryption and security, to form

Symphony Communication Services Holdings LLC.”

In a press release

issued in 2014, Symphony said that its financial institution partners,

in addition to Goldman, included: Bank of America Merrill Lynch, BNY

Mellon, BlackRock, Citadel, Citigroup, Credit Suisse, Deutsche Bank,

Jefferies, JPMorgan, Maverick, Morgan Stanley, Nomura and Wells Fargo.”The New York State Department of Financial Services was sufficiently concerned about the encryption aspect of the Symphony platform that it reached an agreement with four of the banks that it regulates (Goldman Sachs, Deutsche Bank, Credit Suisse, and Bank of New York Mellon) in September of last year.

Anthony J. Albanese, Acting Superintendent of Financial Services, said at the time of the agreement: “We are pleased that these banks did the right thing by working cooperatively with us to help address our concerns about this new messaging platform. This is a critical issue since chats and other electronic records have provided key evidence in investigations of wrongdoing on Wall Street. It is vital that regulators act to ensure that these records do not fall into a digital black hole.”

Initially, Symphony was promoting its platform with a promise of “Guaranteed Data Deletion,” raising red flags among New York State regulators.

Under the agreement with the State of New York, the four banks agreed to retain a copy of all e-communications sent through the Symphony platform for seven years and store duplicate copies of the decryption keys for these communications with independent custodians not controlled by the banks. The other 10 financial firms partnering with Symphony were not, however, parties to the agreement.

The specific language in the agreement noted that the Symphony platform uses “end-to-end encryption” which “enables the transmission of encrypted messages – including chat and instant messages – where only the sender and recipient institutions can decrypt the message using a private decryption key, and Symphony does not have the ability to decrypt the message.”

Why the Vampire Squid Wants Small Depositors’ Money in 1 Frightening Chart

By Pam Martens and Russ Martens: April 27, 2016

Back in 2010, with the public still numb from the epic financial crash and still in the dark about the trillions of dollars of secret loans the Federal Reserve had pumped into the Wall Street mega banks to resuscitate their sinking carcasses, Matt Taibbi penned his classic profile of Goldman Sachs at Rolling Stone, with this, now legendary, summation: “The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.”

Historically, what smells like money to Goldman Sachs has been eight-figure money and higher. As recently as 2013, the New York Times reported that Goldman had a $10 million minimum to manage private wealth and was kicking out its own employees’ brokerage accounts if they were less than $1 million. Now, all of a sudden, Goldman Sachs Bank USA is offering FDIC insured savings accounts with no minimums and certificates of deposits for as little as $500 with above-average yields, meaning it’s going after this money aggressively from the little guy. What could possibly go wrong?

The last utterances we ever hoped to see bundled into a bank promotion were the words “Goldman Sachs” and “FDIC insurance” and “peace-of-mind savings.” But that’s what now greets one at the new online presence of Goldman Sachs Bank USA, thanks to the repeal of the Glass-Steagall Act in 1999, which allowed high-risk investment banks like Goldman Sachs to also own FDIC-insured, deposit-taking banks.

Goldman Sachs has been paying lots of fines for wrongdoing in the past few years, topping off at a cool $5 billion earlier this month for what the U.S. Justice Department characterized as “serious misconduct in falsely assuring investors that securities it sold were backed by sound mortgages, when it knew that they were full of mortgages that were likely to fail.” There was also the $550 million settlement in 2010 with the SEC for Goldman allowing the hedge fund run by billionaire John Paulson to secretly assist it in creating a portfolio designed to fail so Paulson could short it, while Goldman sold it to its own clients without divulging this pesky detail.

Students of Wall Street history may also recall that Goldman’s hubris leading up to the crash of 1929 played a role in why the Glass-Steagall Act of 1933 banned casino-like investment banks from getting near insured deposits. Prior to the ’29 crash, Goldman ran the Goldman Sachs Trading Company, a closed end fund (called a trust in those days). Goldman Sachs also offered that deal to the little guy at $104 a share. The fund appeared to investigators as a dumping ground for Goldman while also paying it a hefty management fee. The little guy who bought the shares at $104 a share at the top of the bull market was left with about a buck and change after the ’29 crash.

So why this generous move now by Goldman Sachs Bank USA to offer above average returns to the little guy? It likely has a lot to do with the chart below from the Office of the Comptroller of the Currency’s (OCC) December 31, 2015 report on the four largest banks based on derivatives exposure. According to the report, the credit exposure from derivatives versus the bank’s risk-based capital is as follows: JPMorgan Chase 209 percent; Bank of America 85 percent; Citibank 166 percent and Goldman Sachs (wait for it) – a whopping 516 percent.

Not to put too fine a point on it, but you might recall that one of the key promises of the Dodd-Frank financial reform legislation was that after the largest bank bailout in financial history in 2008, these derivatives were going to be pushed out of the insured bank into bank affiliates that would not endanger the taxpayer-backstopped deposits and force another monster taxpayer bailout in the next crisis. This became known as the “push-out rule” which could never seem to materialize into a hard and fast law. Then, in December 2014, Citigroup simply used its muscle to legislate the rule out of existence.

The Obama administration also promised that Dodd-Frank would put an end to these trillions of dollars of opaque derivatives being traded in the dark between firms as private contracts (over-the-counter). Dodd-Frank promised to bring them into the sunshine at central clearinghouses. But the December 2015 report from the OCC makes clear that’s just another failed promise, stating:

When you hear Hillary Clinton repeatedly tell the public that she wants to continue along the same pathways as President Obama and that the restoration of the Glass-Steagall Act is not needed, let the image of Goldman Sachs Bank USA and its FDIC insurance logo and its $41 trillion in derivatives come to mind.

Back in 2010, with the public still numb from the epic financial crash and still in the dark about the trillions of dollars of secret loans the Federal Reserve had pumped into the Wall Street mega banks to resuscitate their sinking carcasses, Matt Taibbi penned his classic profile of Goldman Sachs at Rolling Stone, with this, now legendary, summation: “The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.”

Historically, what smells like money to Goldman Sachs has been eight-figure money and higher. As recently as 2013, the New York Times reported that Goldman had a $10 million minimum to manage private wealth and was kicking out its own employees’ brokerage accounts if they were less than $1 million. Now, all of a sudden, Goldman Sachs Bank USA is offering FDIC insured savings accounts with no minimums and certificates of deposits for as little as $500 with above-average yields, meaning it’s going after this money aggressively from the little guy. What could possibly go wrong?

The last utterances we ever hoped to see bundled into a bank promotion were the words “Goldman Sachs” and “FDIC insurance” and “peace-of-mind savings.” But that’s what now greets one at the new online presence of Goldman Sachs Bank USA, thanks to the repeal of the Glass-Steagall Act in 1999, which allowed high-risk investment banks like Goldman Sachs to also own FDIC-insured, deposit-taking banks.

Goldman Sachs has been paying lots of fines for wrongdoing in the past few years, topping off at a cool $5 billion earlier this month for what the U.S. Justice Department characterized as “serious misconduct in falsely assuring investors that securities it sold were backed by sound mortgages, when it knew that they were full of mortgages that were likely to fail.” There was also the $550 million settlement in 2010 with the SEC for Goldman allowing the hedge fund run by billionaire John Paulson to secretly assist it in creating a portfolio designed to fail so Paulson could short it, while Goldman sold it to its own clients without divulging this pesky detail.

Students of Wall Street history may also recall that Goldman’s hubris leading up to the crash of 1929 played a role in why the Glass-Steagall Act of 1933 banned casino-like investment banks from getting near insured deposits. Prior to the ’29 crash, Goldman ran the Goldman Sachs Trading Company, a closed end fund (called a trust in those days). Goldman Sachs also offered that deal to the little guy at $104 a share. The fund appeared to investigators as a dumping ground for Goldman while also paying it a hefty management fee. The little guy who bought the shares at $104 a share at the top of the bull market was left with about a buck and change after the ’29 crash.

So why this generous move now by Goldman Sachs Bank USA to offer above average returns to the little guy? It likely has a lot to do with the chart below from the Office of the Comptroller of the Currency’s (OCC) December 31, 2015 report on the four largest banks based on derivatives exposure. According to the report, the credit exposure from derivatives versus the bank’s risk-based capital is as follows: JPMorgan Chase 209 percent; Bank of America 85 percent; Citibank 166 percent and Goldman Sachs (wait for it) – a whopping 516 percent.

Not to put too fine a point on it, but you might recall that one of the key promises of the Dodd-Frank financial reform legislation was that after the largest bank bailout in financial history in 2008, these derivatives were going to be pushed out of the insured bank into bank affiliates that would not endanger the taxpayer-backstopped deposits and force another monster taxpayer bailout in the next crisis. This became known as the “push-out rule” which could never seem to materialize into a hard and fast law. Then, in December 2014, Citigroup simply used its muscle to legislate the rule out of existence.

The Obama administration also promised that Dodd-Frank would put an end to these trillions of dollars of opaque derivatives being traded in the dark between firms as private contracts (over-the-counter). Dodd-Frank promised to bring them into the sunshine at central clearinghouses. But the December 2015 report from the OCC makes clear that’s just another failed promise, stating:

“In the first quarter of 2015, banks

began reporting their volumes of cleared and non-cleared derivatives

transactions, as well as risk weights for counterparties in each of

these categories. In the fourth quarter of 2015, 36.9 percent of the

derivatives market was centrally cleared.”

According to the OCC, as of December 31, 2015 there were $237

trillion in notional derivatives (face amount) at the 25 largest bank

holding companies with the bulk of that amount on the books of the

insured banks. That compares with $169 trillion on the books of the 25

largest bank holding companies at December 31, 2007, just prior to the

implosions on Wall Street. This means there has been an explosive 40

percent increase in eight years when the Obama administration was

supposed to be reining in risk on Wall Street.When you hear Hillary Clinton repeatedly tell the public that she wants to continue along the same pathways as President Obama and that the restoration of the Glass-Steagall Act is not needed, let the image of Goldman Sachs Bank USA and its FDIC insurance logo and its $41 trillion in derivatives come to mind.

WALL STREET INVESTING IN THE COMMODITIES MARKETS AS EXACTLY WHAT?!

Is the Wall Street Cartel Regrouping? Regulator Fires Warning Shot By Pam Martens and Russ Martens:

| |

| April 28, 2016 |

Bethany Dugan, Deputy Comptroller for Operational Risk at the OCC

Well, apparently, one or more banks are causing concerns in this area again.

Yesterday, the regulator of national banks, the Office of the Comptroller of the Currency, sent out a severe warning to its flock that there could be a five year jail sentence waiting in the wings for anyone attempting to use technology to block its mandated access to bank records. The letter was authored by Bethany Dugan, Deputy Comptroller for Operational Risk. The statement read in part:

“The OCC has become aware of communications technology recently made available to banks that could prevent or impede OCC access to bank records through certain data deletion or encryption features.” Another part of the memo honed in on the chat room issue, noting that “…OCC is aware that some chat and messaging platforms have touted an ability to ‘guarantee’ the deletion of transmitted messages. The permanent deletion of internal communications, especially if occurring within a relatively short time frame, conflicts with OCC expectations of sound governance, compliance, and risk management practices as well as safety and soundness principles.”

Curiously, a footnote called out the Board and bank management of unnamed banks, suggesting that there has been a concerted effort to block the OCC examiners from access to chat rooms and/or to speak directly to bank staff:

“Failure to provide timely access, or

efforts by the board of directors or bank management to impede the bank

staff’s ability to provide such access, may result in enforcement

action. Furthermore, examination obstruction may subject individuals to

criminal prosecution. Refer to 18 USC 1517, ‘Obstructing Examination of

Financial Institution.’ ”

The statute referenced by the OCC, 18 USC 1517, is succinct and

harsh: “Whoever corruptly obstructs or attempts to obstruct any

examination of a financial institution by an agency of the United States

with jurisdiction to conduct an examination of such financial

institution shall be fined under this title, imprisoned not more than 5

years, or both.”Wall Street watchers are speculating that this may be another dustup over the communications system called Symphony that was initiated by Goldman Sachs. Goldman provides a detailed explanation on its web site about how it built out this system and admits that it got a “consortium” of other mega banks and hedge funds to join its plan. It also explains how it hired an expert in “encryption” to head it up, writing:

“In an effort to further develop and

evolve the platform, Goldman Sachs built a consortium of the world’s

leading financial services firms and acquired Perzo, a Palo Alto startup

led by David Gurle, an expert in encryption and security, to form

Symphony Communication Services Holdings LLC.”

In a press release

issued in 2014, Symphony said that its financial institution partners,

in addition to Goldman, included: Bank of America Merrill Lynch, BNY

Mellon, BlackRock, Citadel, Citigroup, Credit Suisse, Deutsche Bank,

Jefferies, JPMorgan, Maverick, Morgan Stanley, Nomura and Wells Fargo.”The New York State Department of Financial Services was sufficiently concerned about the encryption aspect of the Symphony platform that it reached an agreement with four of the banks that it regulates (Goldman Sachs, Deutsche Bank, Credit Suisse, and Bank of New York Mellon) in September of last year.

Anthony J. Albanese, Acting Superintendent of Financial Services, said at the time of the agreement: “We are pleased that these banks did the right thing by working cooperatively with us to help address our concerns about this new messaging platform. This is a critical issue since chats and other electronic records have provided key evidence in investigations of wrongdoing on Wall Street. It is vital that regulators act to ensure that these records do not fall into a digital black hole.”

Initially, Symphony was promoting its platform with a promise of “Guaranteed Data Deletion,” raising red flags among New York State regulators.

Under the agreement with the State of New York, the four banks agreed to retain a copy of all e-communications sent through the Symphony platform for seven years and store duplicate copies of the decryption keys for these communications with independent custodians not controlled by the banks. The other 10 financial firms partnering with Symphony were not, however, parties to the agreement.

The specific language in the agreement noted that the Symphony platform uses “end-to-end encryption” which “enables the transmission of encrypted messages – including chat and instant messages – where only the sender and recipient institutions can decrypt the message using a private decryption key, and Symphony does not have the ability to decrypt the message.”

Why the Vampire Squid Wants Small Depositors’ Money in 1 Frightening Chart

By Pam Martens and Russ Martens: April 27, 2016

Back in 2010, with the public still numb from the epic financial crash and still in the dark about the trillions of dollars of secret loans the Federal Reserve had pumped into the Wall Street mega banks to resuscitate their sinking carcasses, Matt Taibbi penned his classic profile of Goldman Sachs at Rolling Stone, with this, now legendary, summation: “The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.”

Historically, what smells like money to Goldman Sachs has been eight-figure money and higher. As recently as 2013, the New York Times reported that Goldman had a $10 million minimum to manage private wealth and was kicking out its own employees’ brokerage accounts if they were less than $1 million. Now, all of a sudden, Goldman Sachs Bank USA is offering FDIC insured savings accounts with no minimums and certificates of deposits for as little as $500 with above-average yields, meaning it’s going after this money aggressively from the little guy. What could possibly go wrong?

The last utterances we ever hoped to see bundled into a bank promotion were the words “Goldman Sachs” and “FDIC insurance” and “peace-of-mind savings.” But that’s what now greets one at the new online presence of Goldman Sachs Bank USA, thanks to the repeal of the Glass-Steagall Act in 1999, which allowed high-risk investment banks like Goldman Sachs to also own FDIC-insured, deposit-taking banks.

Goldman Sachs has been paying lots of fines for wrongdoing in the past few years, topping off at a cool $5 billion earlier this month for what the U.S. Justice Department characterized as “serious misconduct in falsely assuring investors that securities it sold were backed by sound mortgages, when it knew that they were full of mortgages that were likely to fail.” There was also the $550 million settlement in 2010 with the SEC for Goldman allowing the hedge fund run by billionaire John Paulson to secretly assist it in creating a portfolio designed to fail so Paulson could short it, while Goldman sold it to its own clients without divulging this pesky detail.

Students of Wall Street history may also recall that Goldman’s hubris leading up to the crash of 1929 played a role in why the Glass-Steagall Act of 1933 banned casino-like investment banks from getting near insured deposits. Prior to the ’29 crash, Goldman ran the Goldman Sachs Trading Company, a closed end fund (called a trust in those days). Goldman Sachs also offered that deal to the little guy at $104 a share. The fund appeared to investigators as a dumping ground for Goldman while also paying it a hefty management fee. The little guy who bought the shares at $104 a share at the top of the bull market was left with about a buck and change after the ’29 crash.

So why this generous move now by Goldman Sachs Bank USA to offer above average returns to the little guy? It likely has a lot to do with the chart below from the Office of the Comptroller of the Currency’s (OCC) December 31, 2015 report on the four largest banks based on derivatives exposure. According to the report, the credit exposure from derivatives versus the bank’s risk-based capital is as follows: JPMorgan Chase 209 percent; Bank of America 85 percent; Citibank 166 percent and Goldman Sachs (wait for it) – a whopping 516 percent.

Not to put too fine a point on it, but you might recall that one of the key promises of the Dodd-Frank financial reform legislation was that after the largest bank bailout in financial history in 2008, these derivatives were going to be pushed out of the insured bank into bank affiliates that would not endanger the taxpayer-backstopped deposits and force another monster taxpayer bailout in the next crisis. This became known as the “push-out rule” which could never seem to materialize into a hard and fast law. Then, in December 2014, Citigroup simply used its muscle to legislate the rule out of existence.

The Obama administration also promised that Dodd-Frank would put an end to these trillions of dollars of opaque derivatives being traded in the dark between firms as private contracts (over-the-counter). Dodd-Frank promised to bring them into the sunshine at central clearinghouses. But the December 2015 report from the OCC makes clear that’s just another failed promise, stating:

When you hear Hillary Clinton repeatedly tell the public that she wants to continue along the same pathways as President Obama and that the restoration of the Glass-Steagall Act is not needed, let the image of Goldman Sachs Bank USA and its FDIC insurance logo and its $41 trillion in derivatives come to mind.

Back in 2010, with the public still numb from the epic financial crash and still in the dark about the trillions of dollars of secret loans the Federal Reserve had pumped into the Wall Street mega banks to resuscitate their sinking carcasses, Matt Taibbi penned his classic profile of Goldman Sachs at Rolling Stone, with this, now legendary, summation: “The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.”

Historically, what smells like money to Goldman Sachs has been eight-figure money and higher. As recently as 2013, the New York Times reported that Goldman had a $10 million minimum to manage private wealth and was kicking out its own employees’ brokerage accounts if they were less than $1 million. Now, all of a sudden, Goldman Sachs Bank USA is offering FDIC insured savings accounts with no minimums and certificates of deposits for as little as $500 with above-average yields, meaning it’s going after this money aggressively from the little guy. What could possibly go wrong?

The last utterances we ever hoped to see bundled into a bank promotion were the words “Goldman Sachs” and “FDIC insurance” and “peace-of-mind savings.” But that’s what now greets one at the new online presence of Goldman Sachs Bank USA, thanks to the repeal of the Glass-Steagall Act in 1999, which allowed high-risk investment banks like Goldman Sachs to also own FDIC-insured, deposit-taking banks.

Goldman Sachs has been paying lots of fines for wrongdoing in the past few years, topping off at a cool $5 billion earlier this month for what the U.S. Justice Department characterized as “serious misconduct in falsely assuring investors that securities it sold were backed by sound mortgages, when it knew that they were full of mortgages that were likely to fail.” There was also the $550 million settlement in 2010 with the SEC for Goldman allowing the hedge fund run by billionaire John Paulson to secretly assist it in creating a portfolio designed to fail so Paulson could short it, while Goldman sold it to its own clients without divulging this pesky detail.

Students of Wall Street history may also recall that Goldman’s hubris leading up to the crash of 1929 played a role in why the Glass-Steagall Act of 1933 banned casino-like investment banks from getting near insured deposits. Prior to the ’29 crash, Goldman ran the Goldman Sachs Trading Company, a closed end fund (called a trust in those days). Goldman Sachs also offered that deal to the little guy at $104 a share. The fund appeared to investigators as a dumping ground for Goldman while also paying it a hefty management fee. The little guy who bought the shares at $104 a share at the top of the bull market was left with about a buck and change after the ’29 crash.

So why this generous move now by Goldman Sachs Bank USA to offer above average returns to the little guy? It likely has a lot to do with the chart below from the Office of the Comptroller of the Currency’s (OCC) December 31, 2015 report on the four largest banks based on derivatives exposure. According to the report, the credit exposure from derivatives versus the bank’s risk-based capital is as follows: JPMorgan Chase 209 percent; Bank of America 85 percent; Citibank 166 percent and Goldman Sachs (wait for it) – a whopping 516 percent.

Not to put too fine a point on it, but you might recall that one of the key promises of the Dodd-Frank financial reform legislation was that after the largest bank bailout in financial history in 2008, these derivatives were going to be pushed out of the insured bank into bank affiliates that would not endanger the taxpayer-backstopped deposits and force another monster taxpayer bailout in the next crisis. This became known as the “push-out rule” which could never seem to materialize into a hard and fast law. Then, in December 2014, Citigroup simply used its muscle to legislate the rule out of existence.

The Obama administration also promised that Dodd-Frank would put an end to these trillions of dollars of opaque derivatives being traded in the dark between firms as private contracts (over-the-counter). Dodd-Frank promised to bring them into the sunshine at central clearinghouses. But the December 2015 report from the OCC makes clear that’s just another failed promise, stating:

“In the first quarter of 2015, banks

began reporting their volumes of cleared and non-cleared derivatives

transactions, as well as risk weights for counterparties in each of

these categories. In the fourth quarter of 2015, 36.9 percent of the

derivatives market was centrally cleared.”

According to the OCC, as of December 31, 2015 there were $237

trillion in notional derivatives (face amount) at the 25 largest bank

holding companies with the bulk of that amount on the books of the

insured banks. That compares with $169 trillion on the books of the 25

largest bank holding companies at December 31, 2007, just prior to the

implosions on Wall Street. This means there has been an explosive 40

percent increase in eight years when the Obama administration was

supposed to be reining in risk on Wall Street.When you hear Hillary Clinton repeatedly tell the public that she wants to continue along the same pathways as President Obama and that the restoration of the Glass-Steagall Act is not needed, let the image of Goldman Sachs Bank USA and its FDIC insurance logo and its $41 trillion in derivatives come to mind.

Wednesday, April 27, 2016

KARL MARX ALREADY TAUGHT DAS KAPITAL WOULD BE THE DEVOLUTION OF OUR SPECIES HOMO SAPIENS ~ TIME FOR CHANGE NOW THAT MR HOPE AND NO CHANGE IS GETTING GONE ~ BEGONE DAMN SPOT

Saturday, April 23, 2016

LEGAL FOUNDATION ~ STATE OF WASHINGTON | WASHINGTON STATE TRUST FINANCIAL CENTER WSBA

|

| The members of the Legal Foundation of Washington board are appointed

by the Governor, the Washington State Bar Association Board of

Governors and by the Supreme Court. They are eligible for a two year

term, eligible for re-appointment once. PRESIDENT:PRESIDENT: M. Laurie Flinn Connelly Eastern Washington University https://legalfoundation.org/ Campaign for Equal Justice Board https://legalfoundation.org/ William Gates, Sr |

William Douglas Hyslop

WSBA Number:11256

Admit Date:10/28/1980

Member Status: Active

Public/Mailing Address: Lukins & Annis PS

Wash Trust Fin Ctr # 1600

717 W Sprague Ave

Spokane, WA 99201-0466

United StatesPhone:(509) 455-9555 Fax:(509) 747-2323 TDD: Email:whyslop@lukins.comWebsite:

questions@wsba.org

https://artdailyprayer.wordpress.com/2016/04/23/m-laurie-flinn-connelly-president-legal-foundation-state-of-washington/

717 W Sprague Ave

Spokane, WA 99201-0466

United StatesPhone:(509) 455-9555 Fax:(509) 747-2323 TDD: Email:whyslop@lukins.comWebsite:

questions@wsba.org

https://artdailyprayer.wordpress.com/2016/04/23/m-laurie-flinn-connelly-president-legal-foundation-state-of-washington/

Friday, April 22, 2016

UNITED STATES COURT OF APPEALS FOR THE NINTH CIRCUIT ~ DENISE SUBRAMANIAM vs. MICHAEL WISE MOSMAN ET AL | ROBERTA KELLY DECLARATION IN SUPPORT OF DENISE SUBRAMANIAM

Monday, April 18, 2016

MICHAEL W. MOSMAN, ANN L. AIKEN, TWO (2) "DOCTORATES OF JURISPRUDENCE" WITH CHILDREN (FIVE = MOSMAN, FOUR = AIKEN) & WHAT IS THE STORY OTHER THAN

Sunday, April 17, 2016

Hillary Clinton (D) | Top Contributors, federal election data

Top Contributors, federal election data

Election cycles covered: 2016

This page shows contributions grouped by contributor to the candidate's campaign committee plus any super PACs or hybrid PACs working on his or her behalf.

| Soros Fund Management | $7,039,800 |

| Laborers Union | $4,000,250 |

| Euclidean Capital | $3,502,700 |

| Pritzker Group | $2,814,343 |

| Saban Capital Group | $2,531,995 |

| Paloma Partners | $2,505,400 |

| Herb & Marion Sandler/Sandler Foundation | $2,502,700 |

| Women's Self Worth Foundation | $2,502,700 |

| Priorities USA/Priorities USA Action | $2,151,000 |

| Newsweb Corp | $2,013,500 |

| Renaissance Technologies | $2,010,950 |

| Operating Engineers Union | $2,010,000 |

| Fair Share Action | $2,010,000 |

| Center for Middle East Peace | $2,008,100 |

| Plumbers/Pipefitters Union | $2,005,000 |

| Barbara Lee Family Foundation | $1,749,604 |

| DE Shaw Research | $1,552,950 |

| Carpenters & Joiners Union | $1,505,400 |

| Bohemian Foundation | $1,252,700 |

| American Federation of Teachers | $1,065,755 |

This table lists the top donors to this candidate in the 2016 cycle.

The money came from the organizations' PACs;

their individual members, employees or owners; and those individuals' immediate families. At the federal

level, the organizations themselves did not donate, as they are prohibited by law from doing so. Organization totals include subsidiaries and affiliates.

Why (and How) We Use Donors' Employer/Occupation Information

NOTE: Federal-level numbers are for the 2016 election cycle and based on Federal Election Commission data released electronically on Monday, March 21, 2016.

Why (and How) We Use Donors' Employer/Occupation Information

NOTE: Federal-level numbers are for the 2016 election cycle and based on Federal Election Commission data released electronically on Monday, March 21, 2016.

Feel

free to distribute or cite this material, but please credit the Center

for Responsive Politics. For permission to reprint for commercial uses,

such as textbooks, contact the Center: info@crp.org

Saturday, April 16, 2016

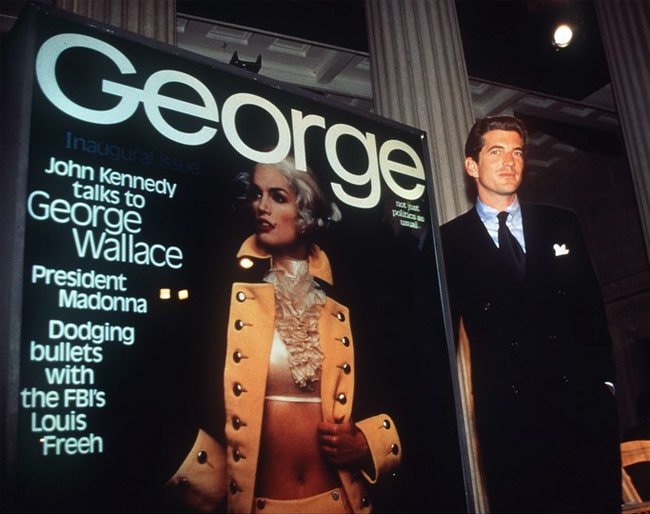

JOHN F KENNEDY JR ALL WARS ARE BANKER$ ~ BANK$TER$ ~ WARS | KILL BILL NO MORE UNITED SLUMS OF APARTHEID | SIMONE ZIMMERMAN SUPER BEING

>> http://beforeitsnews.com/eu/2015/06/jfk-jr-told-the-world-who-murdered-his-father-but-nobody-was-paying-attention-2585092.html

It is indeed well documented that prominent neocons became very influential during the Bush I and Bush II administrations, in 1989-1993 and in 2001-2009. Many people remember how characters such as Paul Wolfowitz, John Bolton, Elliott Abrams, Richard Perle, Douglas Feith, …etc. used different tactics to push the United States into a never-ending imperialistic war, branded as “preemptive wars” in the Middle East, beginning with an unprovoked military aggression against Iraq, in 2003. >> http://www.globalresearch.ca/ten-reasons-why-bill-and-hillary-clinton-do-not-deserve-a-third-term-in-the-white-house/5520424

Ten Reasons Why Bill and Hillary Clinton Do Not Deserve a Third Term in the White House

>> https://artdailyprayer.wordpress.com/2016/04/16/simone-zimmerman-may-the-galactic-federation-fully-protect-her-bernie-sanders-jewish-outreach-director-suspended-for-blunt-and-honest-criticism-of-netanyahu-government/

Tuesday, April 12, 2016

How the United States Became a Prisoner of War and Congress Went MIA ~ Writing a Blank Check on War for the President

|

| Andrew J. Bacevich |

Let’s

face it: in times of war, the Constitution tends to take a beating.

With the safety or survival of the nation said to be at risk, the basic

law of the land — otherwise considered sacrosanct — becomes nonbinding,

subject to being waived at the whim of government authorities who are

impatient, scared, panicky, or just plain pissed off.

The examples are legion. During the Civil War, Abraham Lincoln arbitrarily suspended the writ of habeas corpus and ignored court orders that took issue with his authority to do so. After U.S. entry into World War I, the administration of Woodrow Wilson mounted a comprehensive effort to crush dissent, shutting down anti-war publications in complete disregard of the First Amendment. Amid the hysteria triggered by Pearl Harbor, Franklin Roosevelt issued an executive order consigning to concentration camps more than 100,000 Japanese-Americans, many of them native-born citizens. Asked in 1944 to review this gross violation of due process, the Supreme Court endorsed the government’s action by a 6-3 vote.

More often than not, the passing of the emergency induces second thoughts and even remorse. The further into the past a particular war recedes, the more dubious the wartime arguments for violating the Constitution appear. Americans thereby take comfort in the “lessons learned” that will presumably prohibit any future recurrence of such folly.

Even so, the onset of the next war finds the Constitution once more being ill-treated. We don’t repeat past transgressions, of course. Instead, we devise new ones. So it has been during the ongoing post-9/11 period of protracted war.

During the presidency of George W. Bush, the United States embraced torture as an instrument of policy in clear violation of the Eighth Amendment prohibiting cruel and unusual punishment. Bush’s successor, Barack Obama, ordered the extrajudicial killing of an American citizen, a death by drone that was visibly in disregard of the Fifth and Fourteenth Amendments. Both administrations — Bush’s with gusto, Obama’s with evident regret — imprisoned individuals for years on end without charge and without anything remotely approximating the “speedy and public trial, by an impartial jury” guaranteed by the Sixth Amendment. Should the present state of hostilities ever end, we can no doubt expect Guantánamo to become yet another source of “lessons learned” for future generations of rueful Americans.

Congress on the Sidelines

Yet one particular check-and-balance constitutional proviso now appears exempt from this recurring phenomenon of disregard followed by professions of dismay, embarrassment, and “never again-ism” once the military emergency passes. I mean, of course, Article I, section 8 of the Constitution, which assigns to Congress the authority “to declare war” and still stands as testimony to the genius of those who drafted it. There can be no question that the responsibility for deciding when and whether the United States should fight resides with the legislative branch, not the executive, and that this was manifestly the intent of the Framers.

On parchment at least, the division of labor appears straightforward. The president’s designation as commander-in-chief of the armed forces in no way implies a blanket authorization to employ those forces however he sees fit or anything faintly like it. Quite the contrary: legitimizing presidential command requires explicit congressional sanction.

Actual practice has evolved into something altogether different. The portion of Article I, Section 8, cited above has become a dead letter, about as operative as blue laws still on the books in some American cities and towns that purport to regulate Sabbath day activities. Superseding the written text is an unwritten counterpart that goes something like this: with legislators largely consigned to the status of observers, presidents pretty much wage war whenever, wherever, and however they see fit. Whether the result qualifies as usurpation or forfeiture is one of those chicken-and-egg questions that’s interesting but practically speaking beside the point.

This is by no means a recent development. It has a history. In the summer of 1950, when President Harry Truman decided that a U.N. Security Council resolution provided sufficient warrant for him to order U.S. forces to fight in Korea, congressional war powers took a hit from which they would never recover.

Congress soon thereafter bought into the notion, fashionable during the

Cold War, that formal declarations of hostilities had become passé.

Waging the “long twilight struggle” ostensibly required deference to the

commander-in-chief on all matters related to national security. To

sustain the pretense that it still retained some relevance, Congress

took to issuing what were essentially permission slips, granting

presidents maximum freedom of action to do whatever they might decide

needed to be done in response to the latest perceived crisis.

Congress soon thereafter bought into the notion, fashionable during the

Cold War, that formal declarations of hostilities had become passé.

Waging the “long twilight struggle” ostensibly required deference to the

commander-in-chief on all matters related to national security. To

sustain the pretense that it still retained some relevance, Congress

took to issuing what were essentially permission slips, granting

presidents maximum freedom of action to do whatever they might decide

needed to be done in response to the latest perceived crisis.

The Tonkin Gulf Resolution of 1964 offers a notable example. With near unanimity, legislators urged President Lyndon Johnson “to take all necessary measures to repel any armed attack against the forces of the United States and to prevent further aggression” across the length and breadth of Southeast Asia. Through the magic of presidential interpretation, a mandate to prevent aggression provided legal cover for an astonishingly brutal and aggressive war in Vietnam, as well as Cambodia and Laos. Under the guise of repelling attacks on U.S. forces, Johnson and his successor, Richard Nixon, thrust millions of American troops into a war they could not win, even if more than 58,000 died trying.

To leap almost four decades ahead, think of the Authorization to Use Military Force (AUMF) that was passed by Congress in the immediate aftermath of 9/11 as the grandchild of the Tonkin Gulf Resolution. This document required (directed, called upon, requested, invited, urged) President George W. Bush “to use all necessary and appropriate force against those nations, organizations, or persons he determines planned, authorized, committed, or aided the terrorist attacks that occurred on September 11, 2001, or harbored such organizations or persons, in order to prevent any future acts of international terrorism against the United States by such nations, organizations, or persons.” In plain language: here’s a blank check; feel free to fill it in any way you like.

Forever War

As a practical matter, one specific individual — Osama bin Laden — had hatched the 9/11 plot. A single organization — al-Qaeda — had conspired to pull it off. And just one nation — backward, Taliban-controlled Afghanistan — had provided assistance, offering sanctuary to bin Laden and his henchmen. Yet nearly 15 years later, the AUMF remains operative and has become the basis for military actions against innumerable individuals, organizations, and nations with no involvement whatsoever in the murderous events of September 11, 2001.

Consider the following less than comprehensive list of four developments, all of which occurred just within the last month and a half:

*In Yemen, a U.S. airstrike killed at least 50 individuals, said to be members of an Islamist organization that did not exist on 9/11.

*In Somalia, another U.S. airstrike killed a reported 150 militants, reputedly members of al-Shabab, a very nasty outfit, even if one with no real agenda beyond Somalia itself.

*In Syria, pursuant to the campaign of assassination that is the latest spin-off of the Iraq War, U.S. special operations forces bumped off the reputed “finance minister” of the Islamic State, another terror group that didn’t even exist in September 2001.

*In Libya, according to press reports, the Pentagon is again gearing up for “decisive military action” — that is, a new round of air strikes and special operations attacks to quell the disorder resulting from the U.S.-orchestrated air campaign that in 2011 destabilized that country. An airstrike conducted in late February gave a hint of what is to come: it killed approximately 50 Islamic State militants (and possibly two Serbian diplomatic captives).

Yemen, Somalia, Syria, and Libya share at least this in common: none of them, nor any of the groups targeted, had a hand in the 9/11 attacks.

Imagine if, within a matter of weeks, China were to launch raids into Vietnam, Thailand, and Taiwan, with punitive action against the Philippines in the offing. Or if Russia, having given a swift kick to Ukraine, Georgia, and Azerbaijan, leaked its plans to teach Poland a lesson for mismanaging its internal affairs. Were Chinese President Xi Jinping or Russian President Vladimir Putin to order such actions, the halls of Congress would ring with fierce denunciations. Members of both houses would jostle for places in front of the TV cameras to condemn the perpetrators for recklessly violating international law and undermining the prospects for world peace. Having no jurisdiction over the actions of other sovereign states, senators and representatives would break down the doors to seize the opportunity to get in their two cents worth. No one would be able to stop them. Who does Xi think he is! How dare Putin!

Yet when an American president undertakes analogous actions over which the legislative branch does have jurisdiction, members of Congress either yawn or avert their eyes.

In this regard, Republicans are especially egregious offenders. On matters where President Obama is clearly acting in accordance with the Constitution — for example, in nominating someone to fill a vacancy on the Supreme Court — they spare no effort to thwart him, concocting bizarre arguments nowhere found in the Constitution to justify their obstructionism. Yet when this same president cites the 2001 AUMF as the basis for initiating hostilities hither and yon, something that is on the face of it not legal but ludicrous, they passively assent.

Indeed, when Obama in 2015 went so far as to ask Congress to pass a new AUMF addressing the specific threat posed by the Islamic State — that is, essentially rubberstamping the war he had already launched on his own in Syria and Iraq — the Republican leadership took no action. Looking forward to the day when Obama departs office, Senator Mitch McConnell with his trademark hypocrisy worried aloud that a new AUMF might constrain his successor. The next president will “have to clean up this mess, created by all of this passivity over the last eight years,” the majority leader remarked. In that regard, “an authorization to use military force that ties the president’s hands behind his back is not something I would want to do.” The proper role of Congress was to get out of the way and give this commander-in-chief carte blanche so that the next one would enjoy comparably unlimited prerogatives.

Collaborating with a president they roundly despise — implicitly concurring in Obama’s questionable claim that “existing statutes [already] provide me with the authority I need” to make war on ISIS — the GOP-controlled Congress thereby transformed the post-9/11 AUMF into what has now become, in effect, a writ of permanent and limitless armed conflict. In Iraq and Syria, for instance, what began as a limited but open-ended campaign of air strikes authorized by President Obama in August 2014 has expanded to include an ever-larger contingent of U.S. trainers and advisers for the Iraqi military, special operations forces conducting raids in both Iraq and Syria, the first new all-U.S. forward fire base in Iraq, and at least 5,000 U.S. military personnel now on the ground, a number that continues to grow incrementally.

Remember Barack Obama campaigning back in 2008 and solemnly pledging to end the Iraq War? What he neglected to mention at the time was that he was retaining the prerogative to plunge the country into another Iraq War on his own ticket. So has he now done, with members of Congress passively assenting and the country essentially a prisoner of war.

By now, through its inaction, the legislative branch has, in fact, surrendered the final remnant of authority it retained on matters relating to whether, when, against whom, and for what purpose the United States should go to war. Nothing now remains but to pay the bills, which Congress routinely does, citing a solemn obligation to “support the troops.” In this way does the performance of lesser duties provide an excuse for shirking far greater ones.

http://www.unz.com/article/writing-a-blank-check-on-war-for-the-president/The examples are legion. During the Civil War, Abraham Lincoln arbitrarily suspended the writ of habeas corpus and ignored court orders that took issue with his authority to do so. After U.S. entry into World War I, the administration of Woodrow Wilson mounted a comprehensive effort to crush dissent, shutting down anti-war publications in complete disregard of the First Amendment. Amid the hysteria triggered by Pearl Harbor, Franklin Roosevelt issued an executive order consigning to concentration camps more than 100,000 Japanese-Americans, many of them native-born citizens. Asked in 1944 to review this gross violation of due process, the Supreme Court endorsed the government’s action by a 6-3 vote.

More often than not, the passing of the emergency induces second thoughts and even remorse. The further into the past a particular war recedes, the more dubious the wartime arguments for violating the Constitution appear. Americans thereby take comfort in the “lessons learned” that will presumably prohibit any future recurrence of such folly.

Even so, the onset of the next war finds the Constitution once more being ill-treated. We don’t repeat past transgressions, of course. Instead, we devise new ones. So it has been during the ongoing post-9/11 period of protracted war.

During the presidency of George W. Bush, the United States embraced torture as an instrument of policy in clear violation of the Eighth Amendment prohibiting cruel and unusual punishment. Bush’s successor, Barack Obama, ordered the extrajudicial killing of an American citizen, a death by drone that was visibly in disregard of the Fifth and Fourteenth Amendments. Both administrations — Bush’s with gusto, Obama’s with evident regret — imprisoned individuals for years on end without charge and without anything remotely approximating the “speedy and public trial, by an impartial jury” guaranteed by the Sixth Amendment. Should the present state of hostilities ever end, we can no doubt expect Guantánamo to become yet another source of “lessons learned” for future generations of rueful Americans.

Congress on the Sidelines

Yet one particular check-and-balance constitutional proviso now appears exempt from this recurring phenomenon of disregard followed by professions of dismay, embarrassment, and “never again-ism” once the military emergency passes. I mean, of course, Article I, section 8 of the Constitution, which assigns to Congress the authority “to declare war” and still stands as testimony to the genius of those who drafted it. There can be no question that the responsibility for deciding when and whether the United States should fight resides with the legislative branch, not the executive, and that this was manifestly the intent of the Framers.

On parchment at least, the division of labor appears straightforward. The president’s designation as commander-in-chief of the armed forces in no way implies a blanket authorization to employ those forces however he sees fit or anything faintly like it. Quite the contrary: legitimizing presidential command requires explicit congressional sanction.

Actual practice has evolved into something altogether different. The portion of Article I, Section 8, cited above has become a dead letter, about as operative as blue laws still on the books in some American cities and towns that purport to regulate Sabbath day activities. Superseding the written text is an unwritten counterpart that goes something like this: with legislators largely consigned to the status of observers, presidents pretty much wage war whenever, wherever, and however they see fit. Whether the result qualifies as usurpation or forfeiture is one of those chicken-and-egg questions that’s interesting but practically speaking beside the point.

This is by no means a recent development. It has a history. In the summer of 1950, when President Harry Truman decided that a U.N. Security Council resolution provided sufficient warrant for him to order U.S. forces to fight in Korea, congressional war powers took a hit from which they would never recover.

Congress soon thereafter bought into the notion, fashionable during the

Cold War, that formal declarations of hostilities had become passé.

Waging the “long twilight struggle” ostensibly required deference to the

commander-in-chief on all matters related to national security. To

sustain the pretense that it still retained some relevance, Congress

took to issuing what were essentially permission slips, granting

presidents maximum freedom of action to do whatever they might decide

needed to be done in response to the latest perceived crisis.

Congress soon thereafter bought into the notion, fashionable during the

Cold War, that formal declarations of hostilities had become passé.

Waging the “long twilight struggle” ostensibly required deference to the

commander-in-chief on all matters related to national security. To

sustain the pretense that it still retained some relevance, Congress

took to issuing what were essentially permission slips, granting

presidents maximum freedom of action to do whatever they might decide

needed to be done in response to the latest perceived crisis.The Tonkin Gulf Resolution of 1964 offers a notable example. With near unanimity, legislators urged President Lyndon Johnson “to take all necessary measures to repel any armed attack against the forces of the United States and to prevent further aggression” across the length and breadth of Southeast Asia. Through the magic of presidential interpretation, a mandate to prevent aggression provided legal cover for an astonishingly brutal and aggressive war in Vietnam, as well as Cambodia and Laos. Under the guise of repelling attacks on U.S. forces, Johnson and his successor, Richard Nixon, thrust millions of American troops into a war they could not win, even if more than 58,000 died trying.

To leap almost four decades ahead, think of the Authorization to Use Military Force (AUMF) that was passed by Congress in the immediate aftermath of 9/11 as the grandchild of the Tonkin Gulf Resolution. This document required (directed, called upon, requested, invited, urged) President George W. Bush “to use all necessary and appropriate force against those nations, organizations, or persons he determines planned, authorized, committed, or aided the terrorist attacks that occurred on September 11, 2001, or harbored such organizations or persons, in order to prevent any future acts of international terrorism against the United States by such nations, organizations, or persons.” In plain language: here’s a blank check; feel free to fill it in any way you like.

Forever War

As a practical matter, one specific individual — Osama bin Laden — had hatched the 9/11 plot. A single organization — al-Qaeda — had conspired to pull it off. And just one nation — backward, Taliban-controlled Afghanistan — had provided assistance, offering sanctuary to bin Laden and his henchmen. Yet nearly 15 years later, the AUMF remains operative and has become the basis for military actions against innumerable individuals, organizations, and nations with no involvement whatsoever in the murderous events of September 11, 2001.

Consider the following less than comprehensive list of four developments, all of which occurred just within the last month and a half:

*In Yemen, a U.S. airstrike killed at least 50 individuals, said to be members of an Islamist organization that did not exist on 9/11.

*In Somalia, another U.S. airstrike killed a reported 150 militants, reputedly members of al-Shabab, a very nasty outfit, even if one with no real agenda beyond Somalia itself.

*In Syria, pursuant to the campaign of assassination that is the latest spin-off of the Iraq War, U.S. special operations forces bumped off the reputed “finance minister” of the Islamic State, another terror group that didn’t even exist in September 2001.

*In Libya, according to press reports, the Pentagon is again gearing up for “decisive military action” — that is, a new round of air strikes and special operations attacks to quell the disorder resulting from the U.S.-orchestrated air campaign that in 2011 destabilized that country. An airstrike conducted in late February gave a hint of what is to come: it killed approximately 50 Islamic State militants (and possibly two Serbian diplomatic captives).

Yemen, Somalia, Syria, and Libya share at least this in common: none of them, nor any of the groups targeted, had a hand in the 9/11 attacks.

Imagine if, within a matter of weeks, China were to launch raids into Vietnam, Thailand, and Taiwan, with punitive action against the Philippines in the offing. Or if Russia, having given a swift kick to Ukraine, Georgia, and Azerbaijan, leaked its plans to teach Poland a lesson for mismanaging its internal affairs. Were Chinese President Xi Jinping or Russian President Vladimir Putin to order such actions, the halls of Congress would ring with fierce denunciations. Members of both houses would jostle for places in front of the TV cameras to condemn the perpetrators for recklessly violating international law and undermining the prospects for world peace. Having no jurisdiction over the actions of other sovereign states, senators and representatives would break down the doors to seize the opportunity to get in their two cents worth. No one would be able to stop them. Who does Xi think he is! How dare Putin!

Yet when an American president undertakes analogous actions over which the legislative branch does have jurisdiction, members of Congress either yawn or avert their eyes.

In this regard, Republicans are especially egregious offenders. On matters where President Obama is clearly acting in accordance with the Constitution — for example, in nominating someone to fill a vacancy on the Supreme Court — they spare no effort to thwart him, concocting bizarre arguments nowhere found in the Constitution to justify their obstructionism. Yet when this same president cites the 2001 AUMF as the basis for initiating hostilities hither and yon, something that is on the face of it not legal but ludicrous, they passively assent.

Indeed, when Obama in 2015 went so far as to ask Congress to pass a new AUMF addressing the specific threat posed by the Islamic State — that is, essentially rubberstamping the war he had already launched on his own in Syria and Iraq — the Republican leadership took no action. Looking forward to the day when Obama departs office, Senator Mitch McConnell with his trademark hypocrisy worried aloud that a new AUMF might constrain his successor. The next president will “have to clean up this mess, created by all of this passivity over the last eight years,” the majority leader remarked. In that regard, “an authorization to use military force that ties the president’s hands behind his back is not something I would want to do.” The proper role of Congress was to get out of the way and give this commander-in-chief carte blanche so that the next one would enjoy comparably unlimited prerogatives.

Collaborating with a president they roundly despise — implicitly concurring in Obama’s questionable claim that “existing statutes [already] provide me with the authority I need” to make war on ISIS — the GOP-controlled Congress thereby transformed the post-9/11 AUMF into what has now become, in effect, a writ of permanent and limitless armed conflict. In Iraq and Syria, for instance, what began as a limited but open-ended campaign of air strikes authorized by President Obama in August 2014 has expanded to include an ever-larger contingent of U.S. trainers and advisers for the Iraqi military, special operations forces conducting raids in both Iraq and Syria, the first new all-U.S. forward fire base in Iraq, and at least 5,000 U.S. military personnel now on the ground, a number that continues to grow incrementally.

Remember Barack Obama campaigning back in 2008 and solemnly pledging to end the Iraq War? What he neglected to mention at the time was that he was retaining the prerogative to plunge the country into another Iraq War on his own ticket. So has he now done, with members of Congress passively assenting and the country essentially a prisoner of war.

By now, through its inaction, the legislative branch has, in fact, surrendered the final remnant of authority it retained on matters relating to whether, when, against whom, and for what purpose the United States should go to war. Nothing now remains but to pay the bills, which Congress routinely does, citing a solemn obligation to “support the troops.” In this way does the performance of lesser duties provide an excuse for shirking far greater ones.

In military circles, there is a term to describe this type of behavior. It’s called cowardice.

Andrew Bacevich, a TomDispatch regular, is the author of America’s War for the Greater Middle East: A Military History, which has just been published by Random House.

(Reprinted from TomDispatch by permission of author or representative)

Sunday, April 10, 2016

Saturday, April 9, 2016

The Panama Papers: The People Deceived ~~ NEO ~ New Eastern Outlook, Global Research, Et Al, Et Cetera

Umberto Eco in his last book, Numero Zero, in describing the reality of the manipulating and manipulated western media, has a newspaper editor say, “let’s just stick to spreading suspicion. Someone is involved in fishy business, and though we don’t know who it is, we can give him a scare. That’s enough for our purposes. Then we’ll cash in, our proprietor can cash in, when the time is right.”

And that is exactly what is happening

with the appearance simultaneously in all the western media, on Sunday,

April 3 of a story about what are called the Panama Papers. The story

attributed to a shadowy organisation called the International Coalition

of Investigative Journalists (ICIJ) has all the hallmarks of an

operation by western secret services to attempt to subvert targeted

governments. The primary target is of course President Putin in order to

influence the coming elections and to further attempt to portray him in

the eyes of the peoples of the west as a criminal.

But the targets also include FIFA

directors, continuing the harassment of FIFA by the United States

government, in order to keep Russia out of the next world cup football

games, Lionel Messi one of the world’s best football players, perhaps

because he refused a request by President Obama’s daughters to meet him