The Few Banks that Own All

In

the autumn of 2011 an already legendary study by a number of Swiss

scientists revealed that a small number of banks controlled a decisive

stake in the globe’s economy. The idea that the banks are a cartel and

that this cartel controls the economy is now a scientifically quantified

matter of record.

In

the autumn of 2011 an already legendary study by a number of Swiss

scientists revealed that a small number of banks controlled a decisive

stake in the globe’s economy. The idea that the banks are a cartel and

that this cartel controls the economy is now a scientifically quantified

matter of record.By Anthony Migchels for Henry Makow and Real Currencies

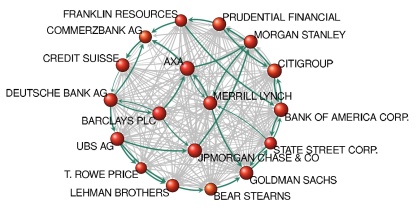

The study, called ‘the Network of Global Corporate Control’ was done by Stefania Vitali, James B. Glattfelder, and Stefano Battiston, in Zurich, Switzerland. The method was datamining the Orbis Marketing Database 2007, with data on more than 30 million economic actors (companies and investors) worldwide, including asset positions.

The study was published in the New Scientist, a highly respected outlet of mainstream science.

The results were interesting, although basically predictable.

Massive centralization

It transpires that there are about 43,000 companies that are Transnational according to the OECD definition.

There is a top 1,318 of them that seem to be at the center of it all. This core group has three important characteristics.

1. Between them, they generated 20% of the world’s income.

2. They own each other.

The Orbis database clearly showed that most shares of these corporations were owned by other members of the group of 1,318. This means that the biggest, most profitable and influential corporations in the world all own each other and are basically one massive cartel, or even monopoly. They are competing only nominally. Competition is sin.

3. The core owns all the other biggest 43,000 Transnational corporations.

These companies generate another 60% of the entire world’s income. So not only is the top of the business world one major cartel, it controls or outright owns all of its lesser brethren, confirming the idea of one incredible monopoly owning the entire world.

Besides these three issues with the core of 1,318, there are two more shocking observations:

4. 80% of the total control was in the hands of an even smaller group of 737 corporations.

5. And last but not least: at the very top, only 147 corporations directly control 40% of the total wealth.

ConclusionSee the top 50 of this list below the article.

As you can see from that list, they are all banks or other financial institutions.

So no, it’s not a hyperbole to say the Banking System is One. We’re not overstating the case when we say it’s just one massive cartel. That the banks own everything, including all the major industries. Oil, Weapons, Pharmaceuticals, Food, Telecom and IT, etc. It’s all one massive monopoly. Controlled from the top down.

The Money Power is real and these Swiss gentlemen have done us a favor by crunching the numbers.

Questions remain. How do the CAFR’s of US Governmental pension funds and the like fit in this picture? How are the companies controlled if they all own each other?

However, the last few years we have seen conspiracy theory getting validated more and more everyday. People are still surprised, but that is only because they don’t understand human nature. People conspire to do just about everything. It would have been really surprising had there not been a conspiracy to rule the world.

Related:

Understand the Banking System is One

Liebor, the Biggest Scam in History?

Take your money out of the bank NOW! (with video)

For this article I am indebted to David Wilcock.

1 BARCLAYS PLC GB 6512 SCC 4.05

2 CAPITAL GROUP COMPANIES INC, THE US 6713 IN 6.66

3 FMR CORP US 6713 IN 8.94

4 AXA FR 6712 SCC 11.21

5 STATE STREET CORPORATION US 6713 SCC 13.02

6 JP MORGAN CHASE & CO. US 6512 SCC 14.55

7 LEGAL & GENERAL GROUP PLC GB 6603 SCC 16.02

8 VANGUARD GROUP, INC., THE US 7415 IN 17.25

9 UBS AG CH 6512 SCC 18.46

10 MERRILL LYNCH & CO., INC. US 6712 SCC 19.45

11 WELLINGTON MANAGEMENT CO. L.L.P. US 6713 IN 20.33

12 DEUTSCHE BANK AG DE 6512 SCC 21.17

13 FRANKLIN RESOURCES, INC. US 6512 SCC 21.99

14 CREDIT SUISSE GROUP CH 6512 SCC 22.81

15 WALTON ENTERPRISES LLC US 2923 T&T 23.56

16 BANK OF NEW YORK MELLON CORP. US 6512 IN 24.28

17 NATIXIS FR 6512 SCC 24.98

18 GOLDMAN SACHS GROUP, INC., THE US 6712 SCC 25.64

19 T. ROWE PRICE GROUP, INC. US 6713 SCC 26.29

20 LEGG MASON, INC. US 6712 SCC 26.92

21 MORGAN STANLEY US 6712 SCC 27.56

22 MITSUBISHI UFJ FINANCIAL GROUP, INC. JP 6512 SCC 28.16

23 NORTHERN TRUST CORPORATION US 6512 SCC 28.72

24 SOCIÉTÉ GÉNÉRALE FR 6512 SCC 29.26

25 BANK OF AMERICA CORPORATION US 6512 SCC 29.79

26 LLOYDS TSB GROUP PLC GB 6512 SCC 30.30

27 INVESCO PLC GB 6523 SCC 30.82

28 ALLIANZ SE DE 7415 SCC 31.32

29 TIAA US 6601 IN 32.24

30 OLD MUTUAL PUBLIC LIMITED COMPANY GB 6601 SCC 32.69

31 AVIVA PLC GB 6601 SCC 33.14

32 SCHRODERS PLC GB 6712 SCC 33.57

33 DODGE & COX US 7415 IN 34.00

34 LEHMAN BROTHERS HOLDINGS, INC. US 6712 SCC 34.43

35 SUN LIFE FINANCIAL, INC. CA 6601 SCC 34.82

36 STANDARD LIFE PLC GB 6601 SCC 35.2

37 CNCE FR 6512 SCC 35.57

38 NOMURA HOLDINGS, INC. JP 6512 SCC 35.92

39 THE DEPOSITORY TRUST COMPANY US 6512 IN 36.28

40 MASSACHUSETTS MUTUAL LIFE INSUR. US 6601 IN 36.63

41 ING GROEP N.V. NL 6603 SCC 36.96

42 BRANDES INVESTMENT PARTNERS, L.P. US 6713 IN 37.29

43 UNICREDITO ITALIANO SPA IT 6512 SCC 37.61

44 DEPOSIT INSURANCE CORPORATION OF JP JP 6511 IN 37.93

45 VERENIGING AEGON NL 6512 IN 38.25

46 BNP PARIBAS FR 6512 SCC 38.56

47 AFFILIATED MANAGERS GROUP, INC. US 6713 SCC 38.88

48 RESONA HOLDINGS, INC. JP 6512 SCC 39.18

49 CAPITAL GROUP INTERNATIONAL, INC. US 7414 IN 39.48

50 CHINA PETROCHEMICAL GROUP CO. CN 6511 T&T 39.78

No comments:

Post a Comment