|

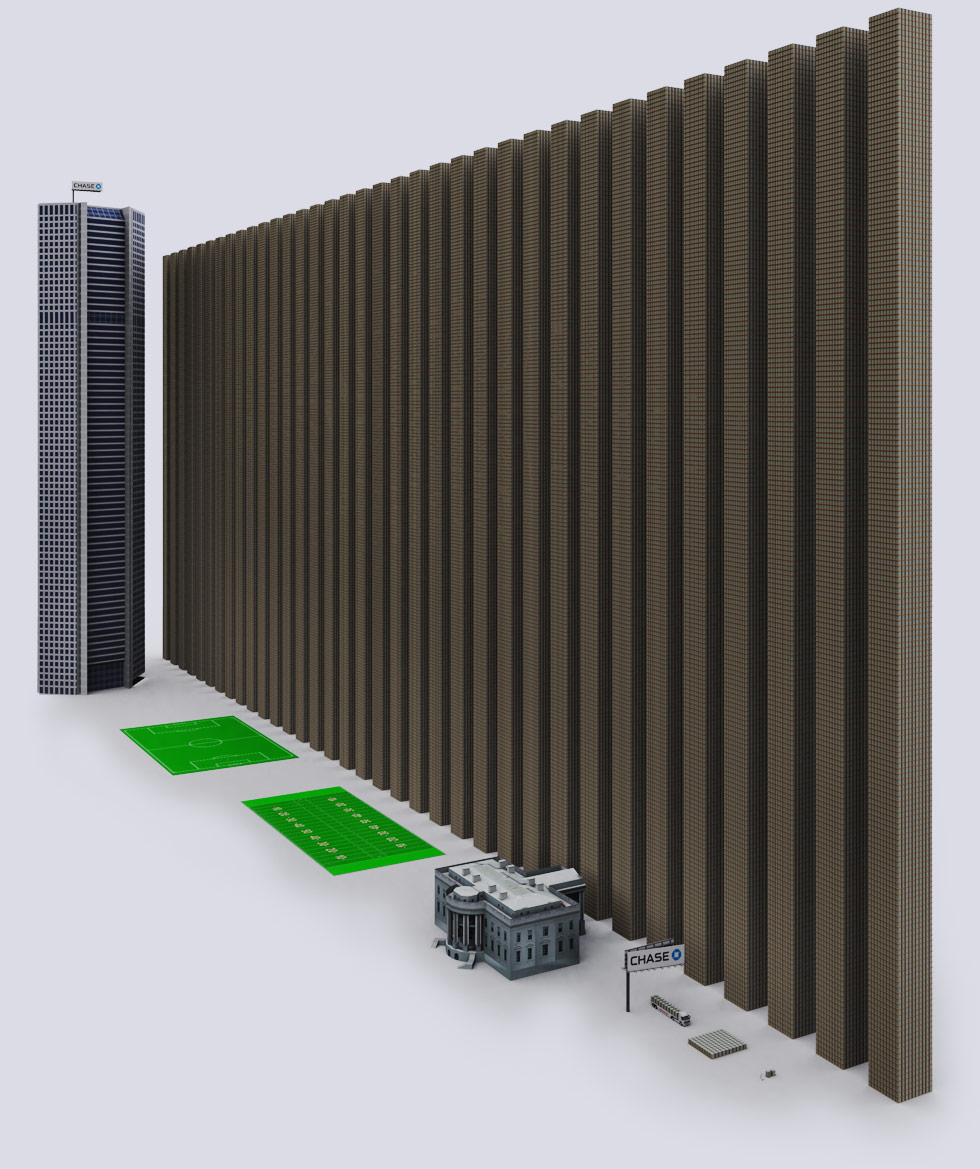

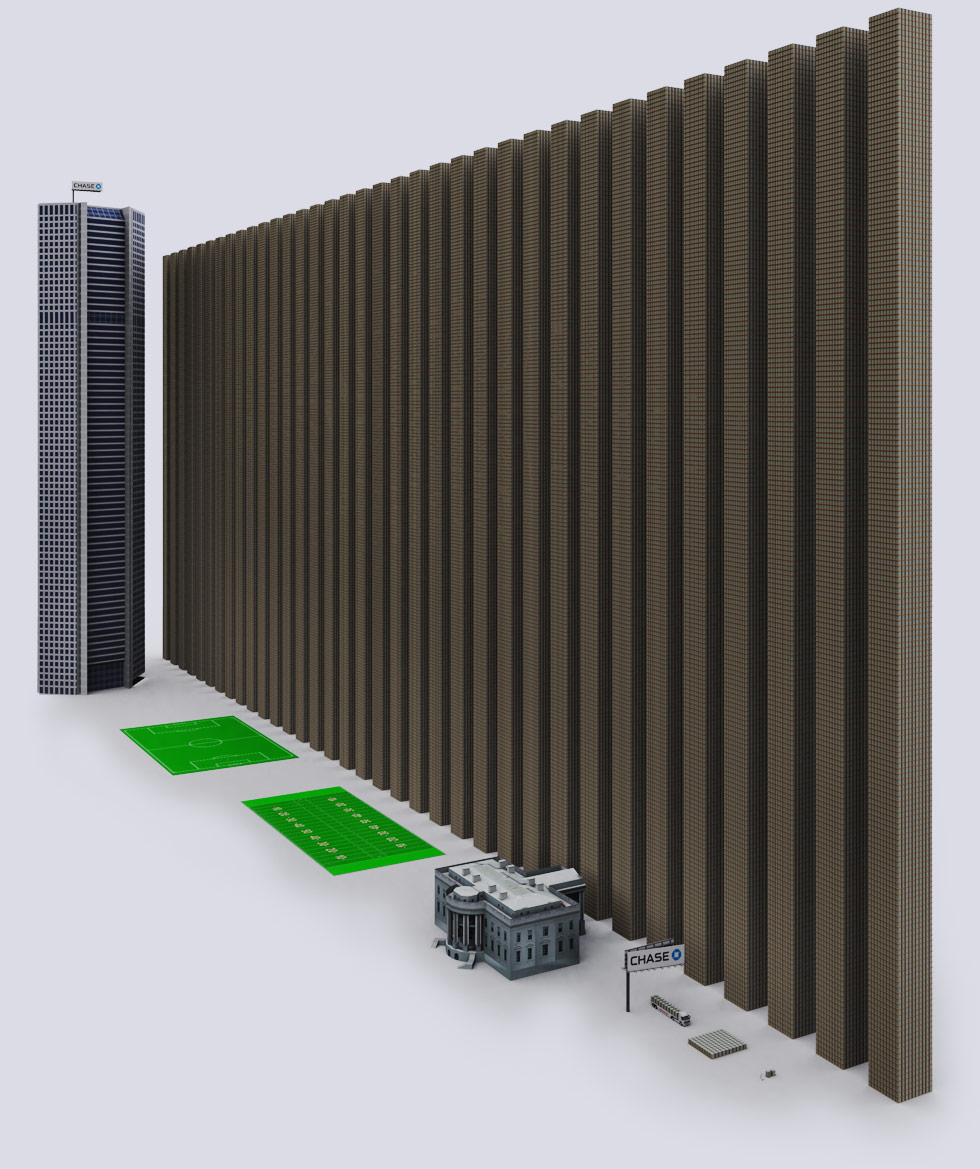

Note the little man standing in front of white house. The little worm next to last football field is a truck with $2 billion dollars.

There is no government in the world that has this kind of

money. This is roughly 3 times the entire world economy. The unregulated

market presents a massive financial risk. The corruption and immorality of the banks makes the situation worse. |

9 Biggest Banks' Derivative Exposure - $228.72 Trillion

|

| If you don't want to bank with these banks, but want

to have access to free ATM's anywhere-- most Credit Unions in USA are in the CO-OP ATM network,

where all ATM's are free to any COOP CU member and most support

depositing checks. The Credit Unions are like banks, but invest all

their profits to give members lower rates and better service. They don't

have shareholders to worry about or have derivatives to purchase and sell. |

|

Keep an eye out in the news for "derivative crisis", as the crisis is inevitable with current falling value of most real assets.

Derivative Data Source: ZeroHedge

|

|

If you don't want to bank with these banks, but want

to have access to free ATM's anywhere-- most Credit Unions in USA are in the CO-OP ATM network,

where all ATM's are free to any COOP CU member and most support

depositing checks. The Credit Unions are like banks, but invest all

their profits to give members lower rates and better service. They don't

have shareholders to worry about or have derivatives to purchase and sell.

|

>> As one Judge told me recently, he has come to realize that clearing his

docket is easier than he thought. Just require the a party seeking

foreclosure to prove that they or the predecessor actually made a loan

to the homeowner.

>> http://livinglies.wordpress.com/2013/11/05/mmodifications-up-foreclosures-down-scams-up/

SHORT STORY: Pick something of value, make bets on the future value of "something", add contract & you have a derivative.

Banks make massive profits on derivatives, and when the

bubble bursts chances are the tax payer will end up with the bill.

This visualizes the total coverage for derivatives

(notional). Similar to insurance company's total coverage for all cars. |

|

LONG STORY: A derivative is a legal

bet (contract) that derives its value from another asset, such as the

future or current value of oil, government bonds or anything else.

Ex- A derivative buys you the option (but not obligation) to

buy oil in 6 months for today's price/any agreed price, hoping that

oil will cost more in future. (I'll bet you it'll cost more in 6

months).

Derivative can also be used as insurance, betting that a

loan will or won't default before a given date. So its a big betting

system, like a Casino, but instead of betting on cards and roulette, you

bet on future values and performance of practically anything that holds

value. The system is not regulated what-so-ever, and you can buy a

derivative on an existing derivative.

|

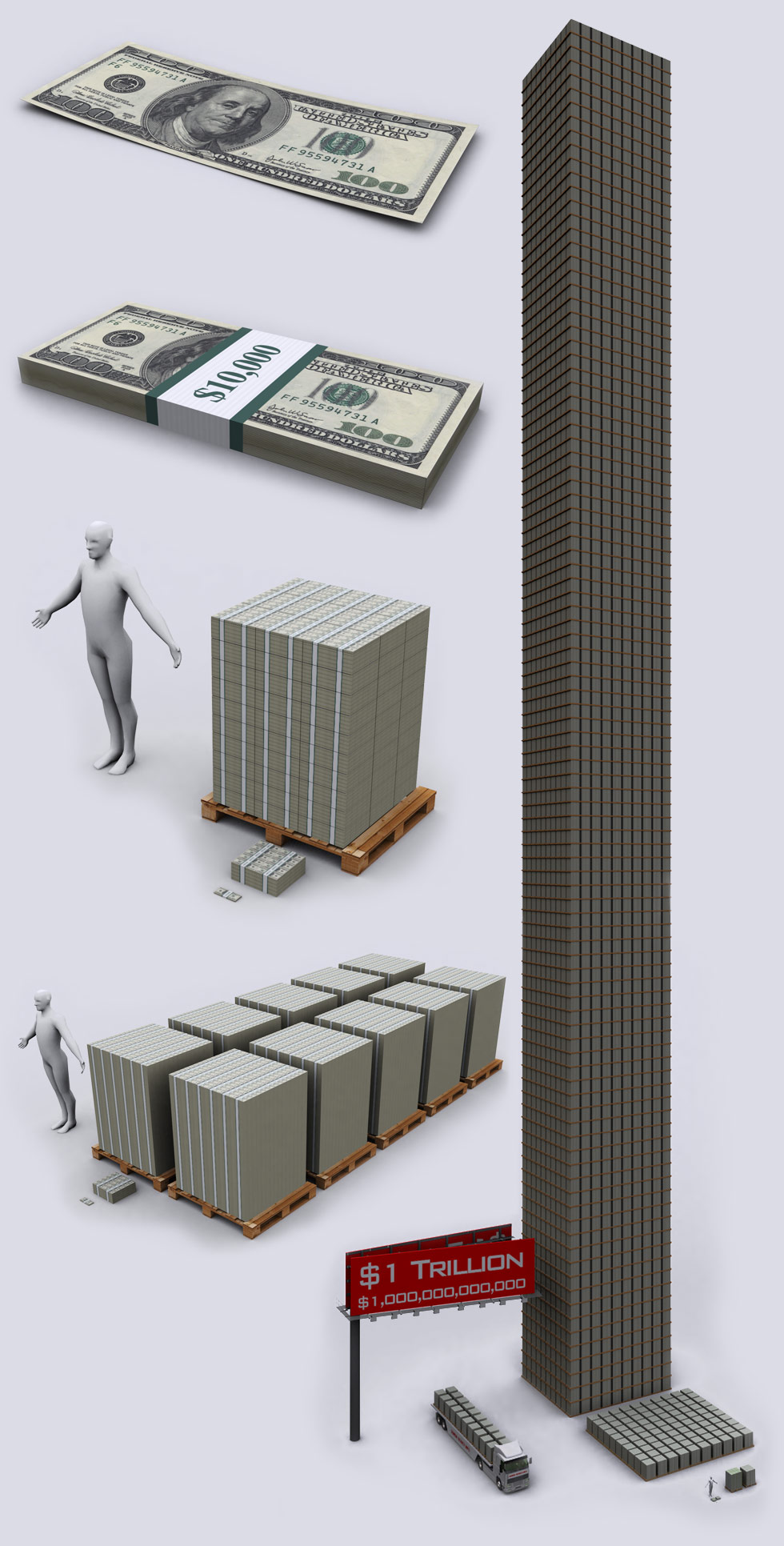

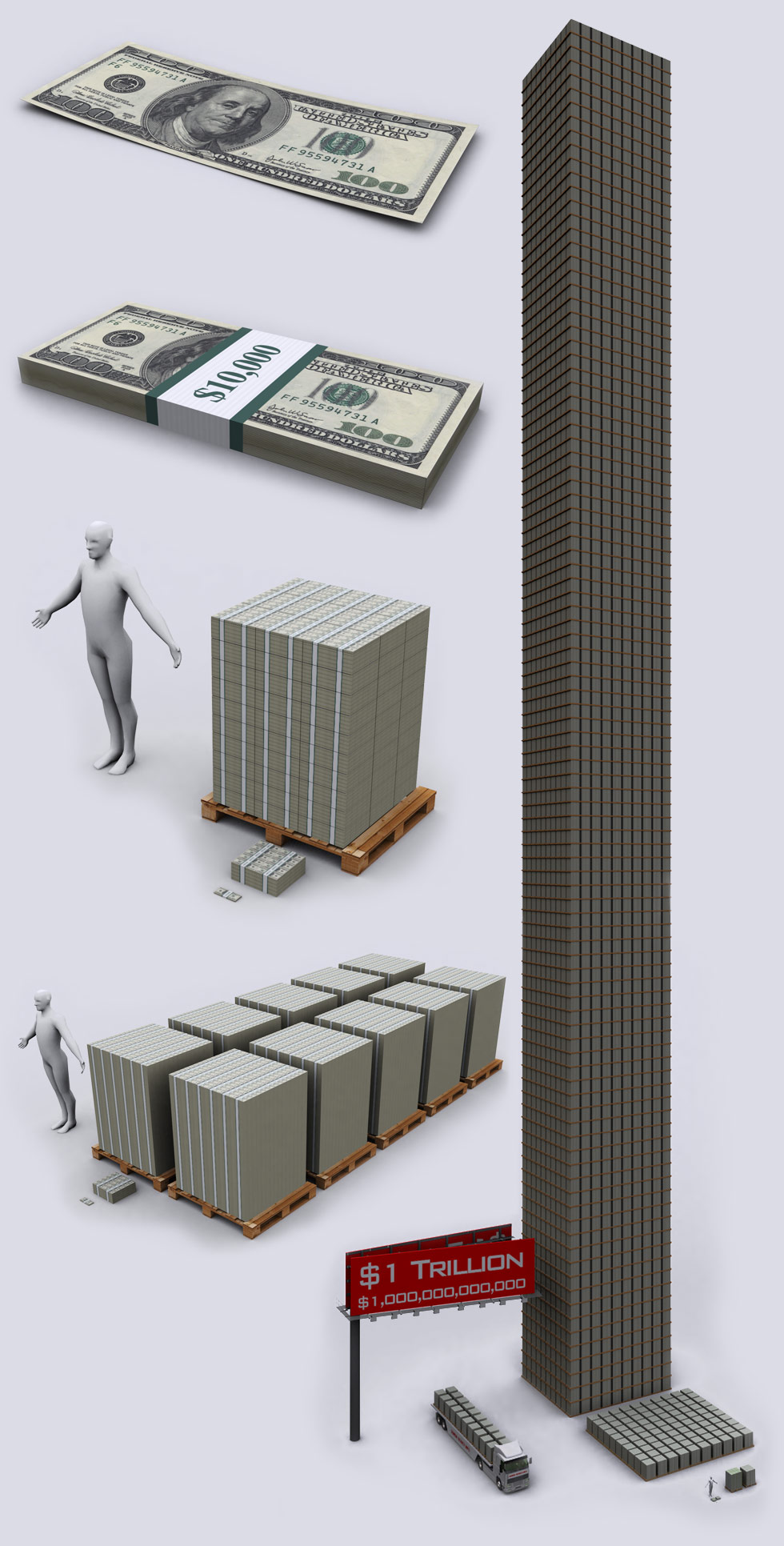

| One Hundred Dollars |

$100 - Most counterfeited money denomination in the world.

Keeps the world moving. |

| Ten Thousand Dollars |

$10,000 - Enough for a great vacation or to buy a used car.

Approximately one year of work for the average human on earth. |

| 100 Million Dollars |

$100,000,000 - Plenty to go around for

everyone.

Fits nicely on an ISO / Military

standard sized pallet.

$1 Million is the cash square on the floor.

|

| 1 Billion Dollars |

$1,000,000,000 - This is how a billion dollars looks like.

10 pallets of $100 bills.

|

| 1 Trillion Dollars |

| $1,000,000,000,000

- When they throw around the word "Trillion" like it is nothing, this

is the reality of $1 trillion dollars. The square of

pallets to the right is $10 billion dollars. 100x that and you have the

tower of $1 trillion that is 465 feet tall (142 meters).

|

http://demonocracy.info/infographics/usa/derivatives/bank_exposure.html

Most large banks try to prevent smaller investors from gaining access to the derivative market on the basis of there being too much risk. Derivatives - Approximately 3 times the entire world economy. No government in world has money for this bailout. Lets take a look at what banks have the biggest Derivative Exposures and what scandals they've been lately involved in. Derivative Data Source: ZeroHedge.

ReplyDelete